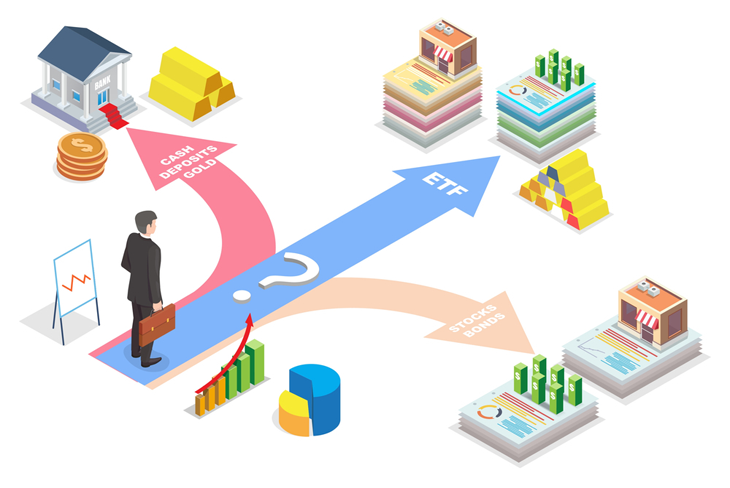

As you near retirement, it’s crucial to have a well-diversified investment portfolio that can provide steady returns. Traditionally, retirement portfolios consist mainly of stocks and bonds. However, adding alternate investment funds can provide further diversification and help manage risk. Here’s an overview of how alternative investment funds can fit into your retirement planning.

What are Alternative Investment Funds?

Alternative investment funds or alternative mutual funds are vehicles that don’t fall into the traditional categories of stocks, bonds, and cash.

These assets tend to perform differently than traditional investments and can provide returns that aren’t directly correlated to the stock market. This helps reduce overall portfolio risk through diversification.

Alternative investments are usually structured as limited partnerships and managed by an alternative investment fund manager. The manager invests in various alternative assets on behalf of the limited partner investors. The funds often require high minimum investments and have lock-up periods where you can’t access your money. The funds also tend to be less liquid than traditional investments.

Benefits for Retirement Investors

Adding alternative investments to your retirement portfolio can provide several key benefits:

Reduced volatility – Alternative assets exhibit lower correlations to stocks and bonds, smoothing out returns over time. This results in lower portfolio volatility than solely invested in stocks and bonds.

Diversification – Each alternative asset class has its return drivers, providing diversification across multiple sources of return. This enhances the stability of your overall portfolio.

Steady returns – Many alternative assets generate steady returns year after year, unlike the volatility of the stock market. Real estate and infrastructure funds produce regular income. This income can supplement other retirement income sources.

Hedge against inflation – Alternative investments in real assets like real estate and commodities can provide a hedge against inflation. This helps retirees maintain purchasing power over time.

Potentially higher returns – Alternative investments expose return drivers not available through traditional asset classes. This can enhance overall portfolio returns.

Types of Alternative Investment Funds

Some specific types of alternative funds suitable for retirement investors include:

Real estate funds – These invest in various real estate properties and can provide steady rental income. Real estate also acts as an inflation hedge.

Structured credit funds – These invest in pools of debt securities with varying levels of risk/return. The income can act as a fixed income replacement.

Infrastructure funds – Infrastructure assets like toll roads and pipelines generate stable long-term income streams. The funds provide diversification from stocks and bonds.

Managed futures funds – These invest in liquid futures contracts in areas like currencies, commodities, and interest rates. The fund provides portfolio diversification through non-correlation to traditional assets.

Commodity funds – These hold commodities like precious metals, agriculture, energy, and industrial metals. Commodities act as an inflation hedge.

Risks and Drawbacks

While alternative funds provide diversification benefits, they do come with some downsides to consider:

High fees – Alternative funds have much higher fees compared to index funds and ETFs. This eats into returns over time.

Illiquidity – Many alternative investments cannot be sold quickly to access your money. Retirement investors should consider liquidity needs.

Complex tax structures – Alternative funds often generate taxable distributions like income and capital gains. This complicates tax planning in retirement.

Higher investment minimums – Most individual alternative funds have high minimums of $50,000 or more. This requires a larger pool of investable assets.

It’s important to work with a financial advisor to determine if alternative investments match your risk profile, liquidity needs, and total net worth considerations. Alternative funds are complex assets best used as a supporting part of an overall portfolio strategy. But used judiciously, they can enhance retirement portfolio stability and returns.

The diversification and return potential of alternative investments make them worth considering for retirees. But be sure to evaluate the risks and fit for your personal financial situation before investing. With the right alternative fund selections, your retirement portfolio can benefit from smoother returns, inflation hedging, and enhanced diversification.